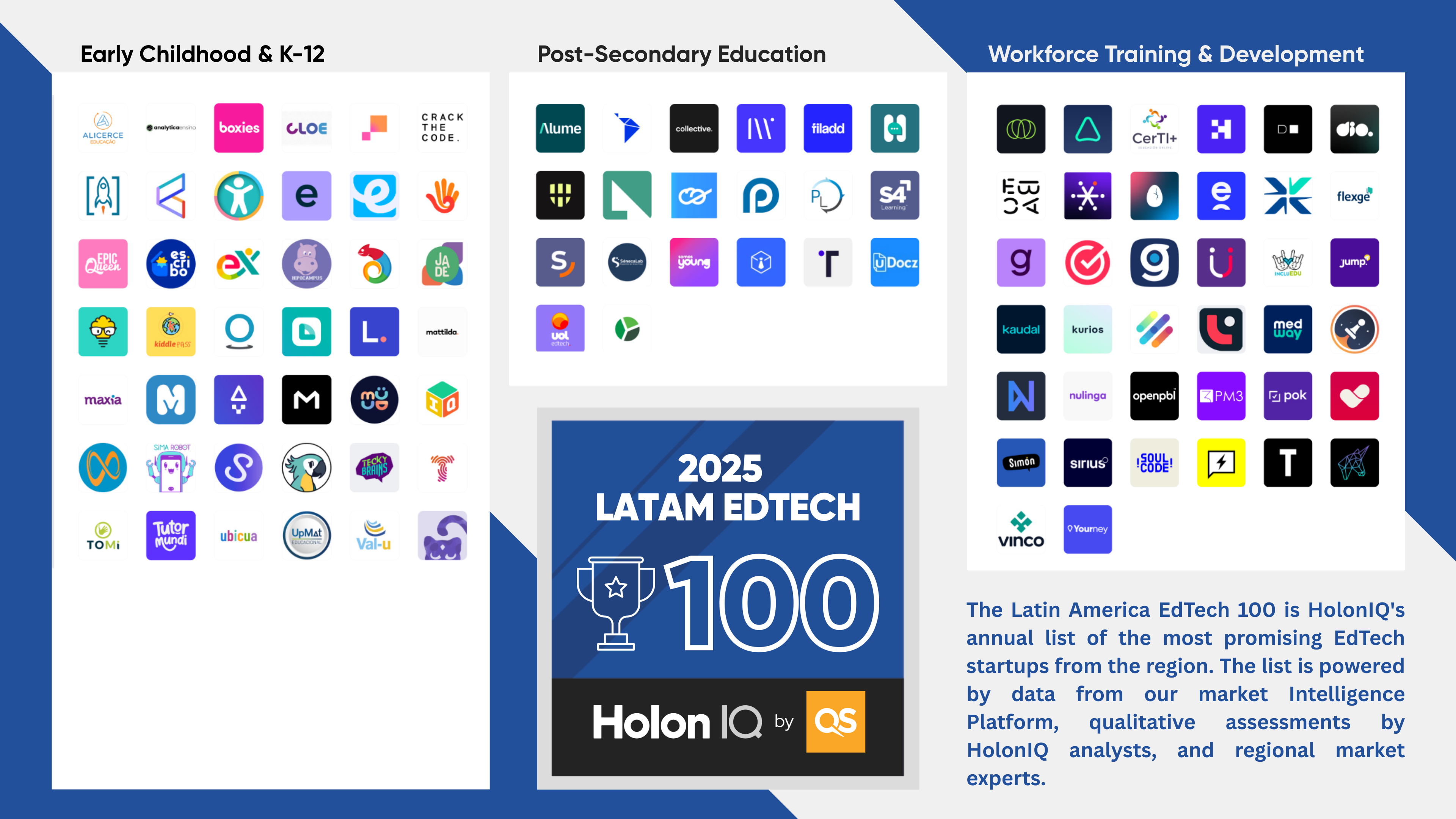

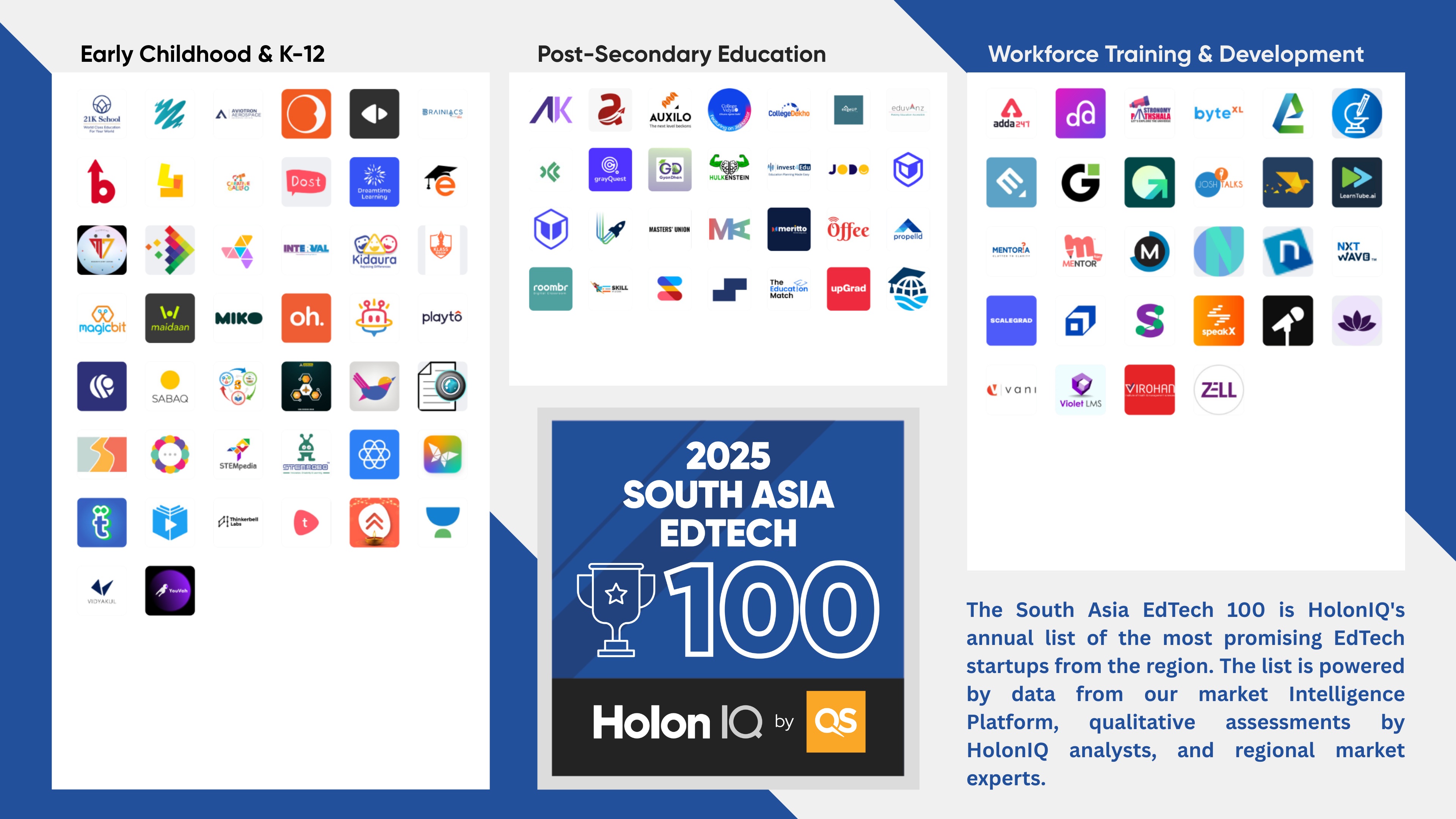

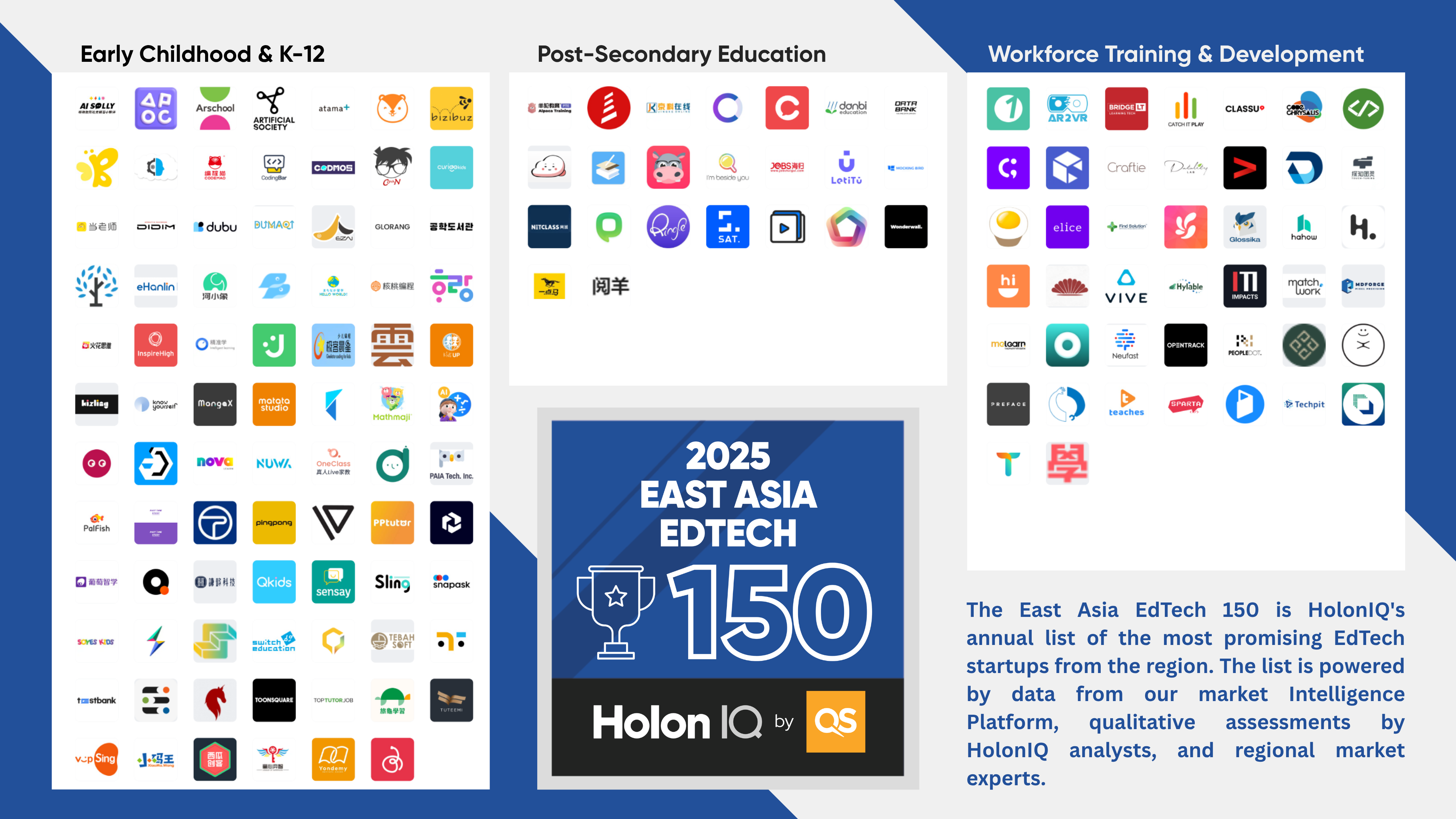

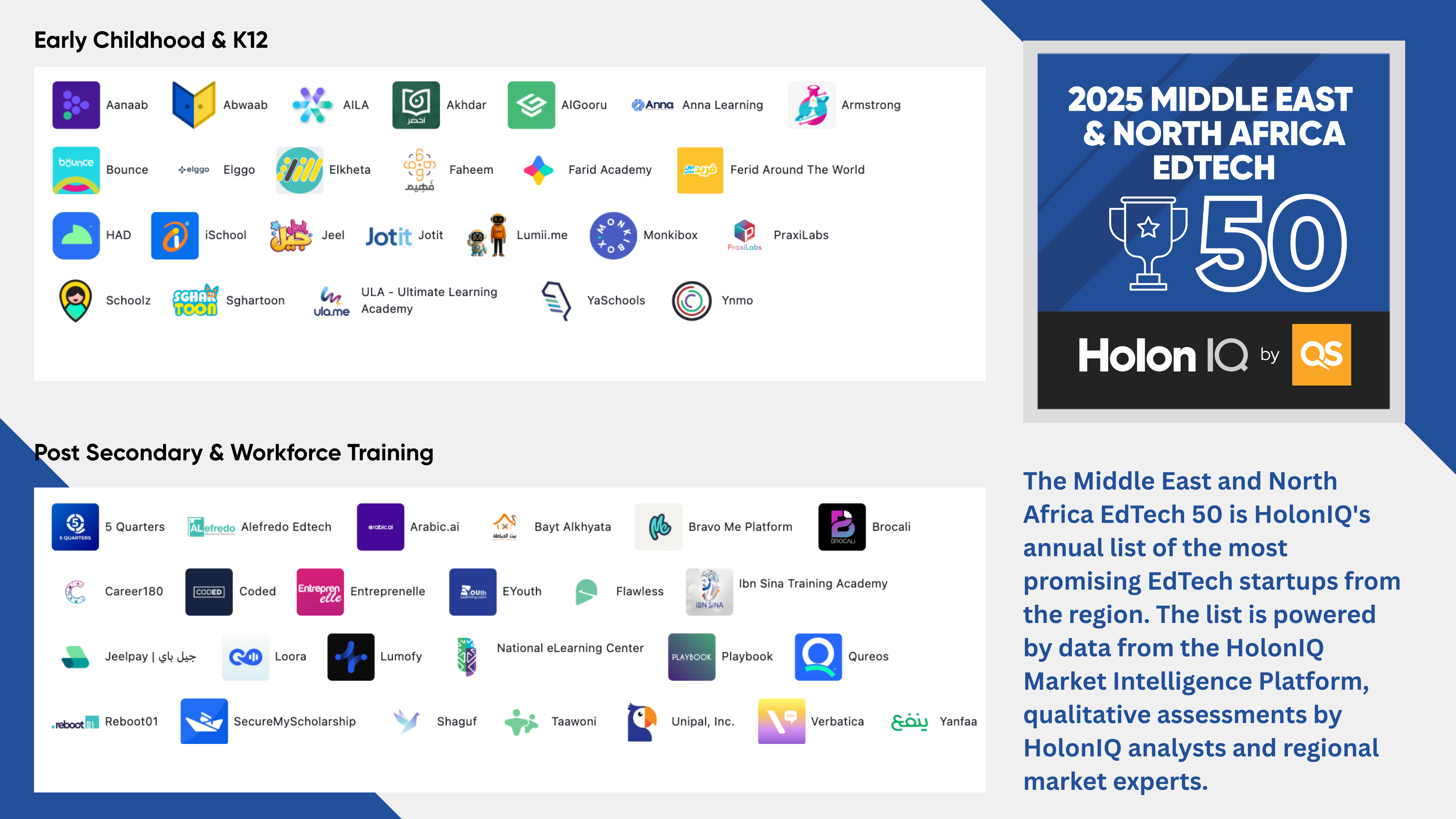

Every year, HolonIQ’s Education Intelligence Unit identifies the most promising 1000 EdTech startups around the world. The global 1000 is built region by region from over 10,000 nominations, applications and screening to ensure the global cohort is diverse and to shine a light on the inspiring innovation happening all around the world.

Each regional list is focused on identifying young, fast growing, and innovative learning and upskilling start-ups. To be eligible, startups are generally less than 10 years old (though there are some exceptions), are either headquartered in the region, or predominately focused on the market (e.g. > 80% revenue/customers), are pre exit (not acquired or listed) and not a subsidiary of a larger company or controlled by an investor group (e.g. via private equity buyout or controlling investment).

The HolonIQ Education Intelligence Unit and select market experts assess each organization based on HolonIQ’s startup scoring rubric, which covers the following dimensions:

Market. The quality and relative attractiveness of the specific market category in which the company competes.

Product. The quality, uniqueness and impact of the product itself.

Team. The expertise and diversity of the leadership team.

Capital. The financial health of the company and its ability to generate or secure sufficient funding.

Momentum. Positive changes in the size, velocity and impact of the company over time.

Fewer Early-Stage Startups. Regional Disparities Persist.

The 2024 Global EdTech 1000 illustrates a notable shift in the age distribution of startups. Only 17% of the cohort were founded within the last three years, compared to 23% in 2023. This decline reflects tightening funding conditions, with venture capital increasingly prioritizing profitability and growth metrics. Regional variations stand out: Oceania, East Asia, and South Asia host the most mature cohorts, while over 20% of startups in Latin America, Europe, North America, and Sub-Saharan Africa are under three years old. This regional diversity underscores the influence of local funding ecosystems and entrepreneurial support in shaping EdTech innovation. Notable examples include Mockingbird, a mentoring platform from East Asia, and Teachy, a K-12 instructional support solution from Latin America.

.png)

.png)